Property purchases in Singapore can be some of the most lucrative if done right. However, it is without a doubt challenging. For instance, anyone looking to invest in the property project should understand what it offers in its entirety.

You need to follow a process, and some decisions need to be made early on. Like buying property anywhere else in the world, in Singapore too, owners incur costs like repairs, maintenance, and a commitment.

Do Your Research

Researching the market is a great way to find out what type of properties are available and what you can expect to pay. Prepare a short list of homes that meet your requirements. Your requirements may include things like:

- The number of bedrooms.

- The overall size of the home or real estate.

- Your preferred location.

- Reoccurring costs associated with the property.

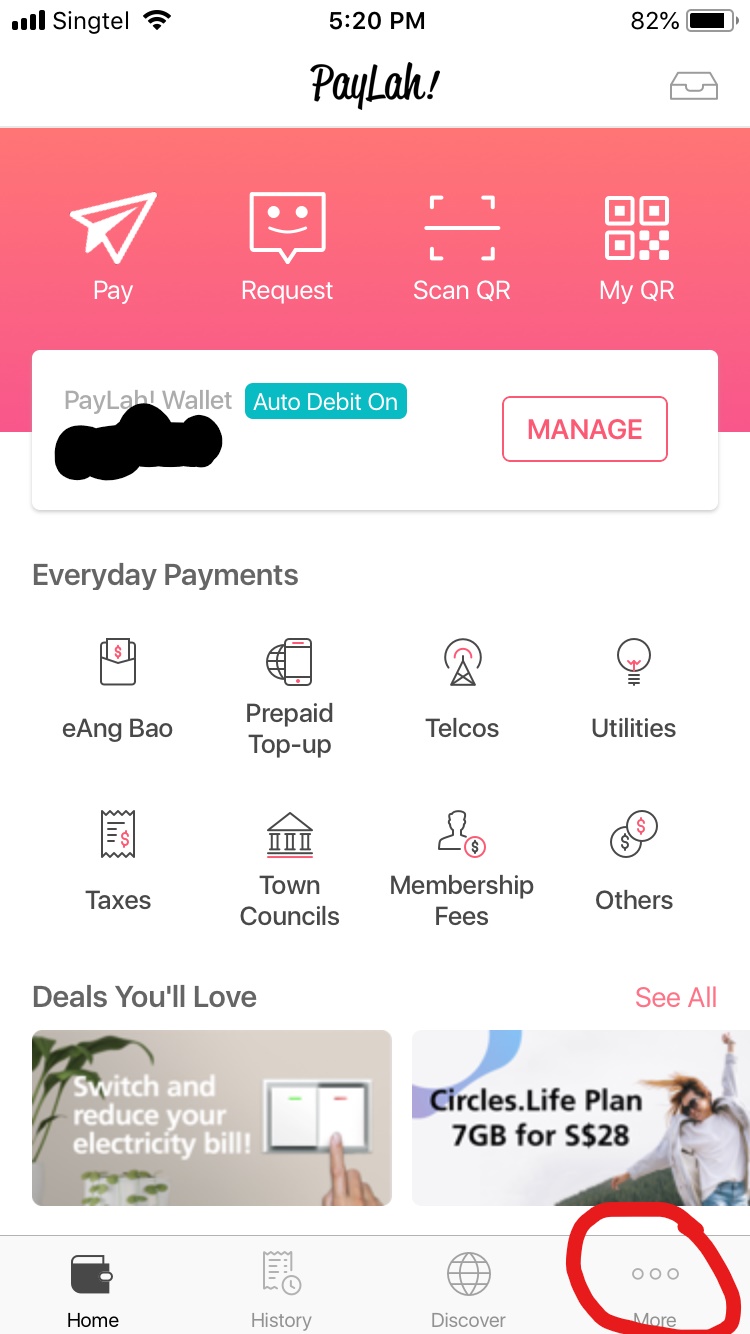

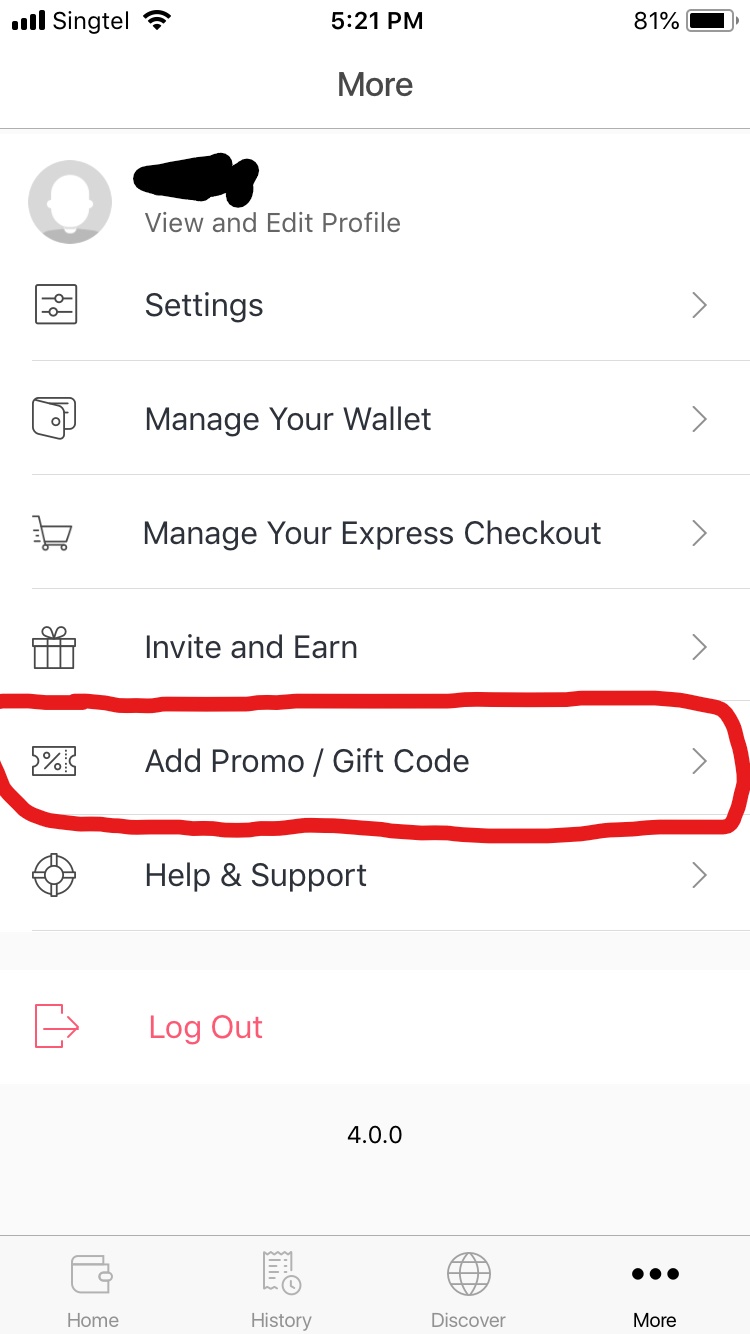

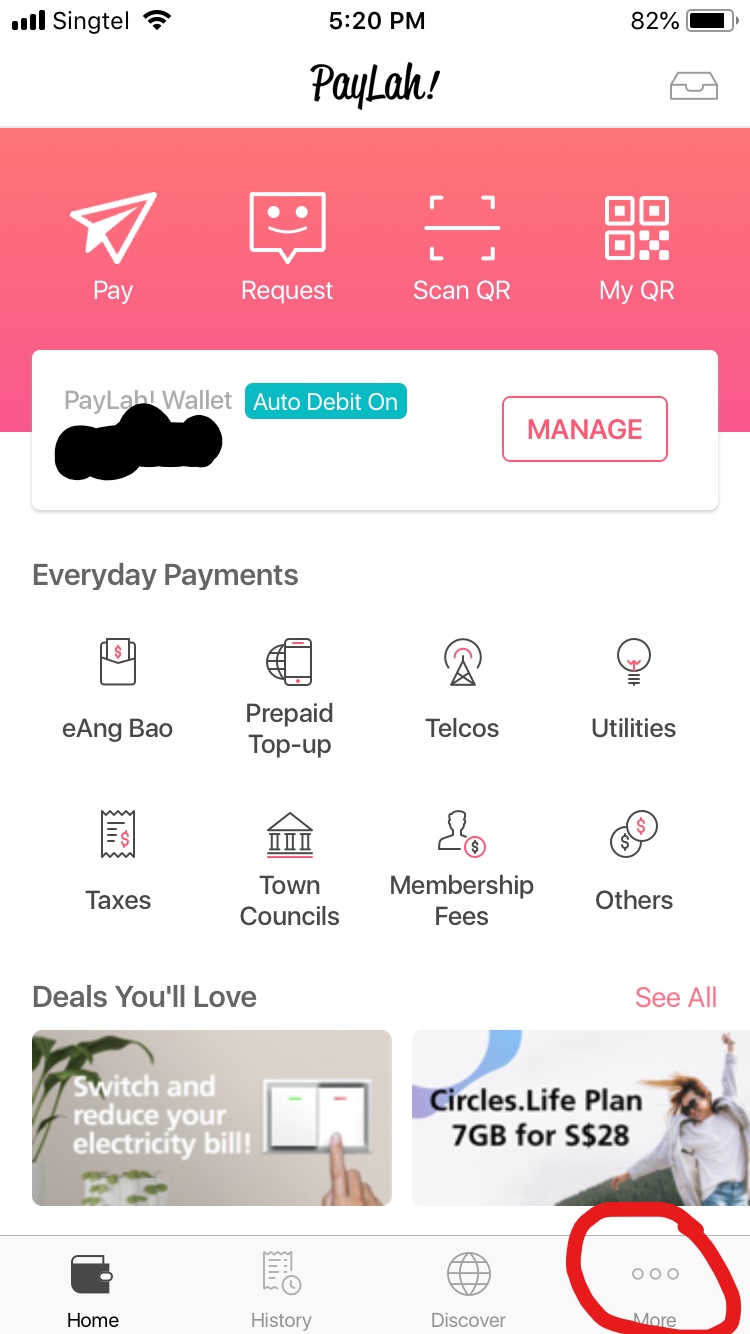

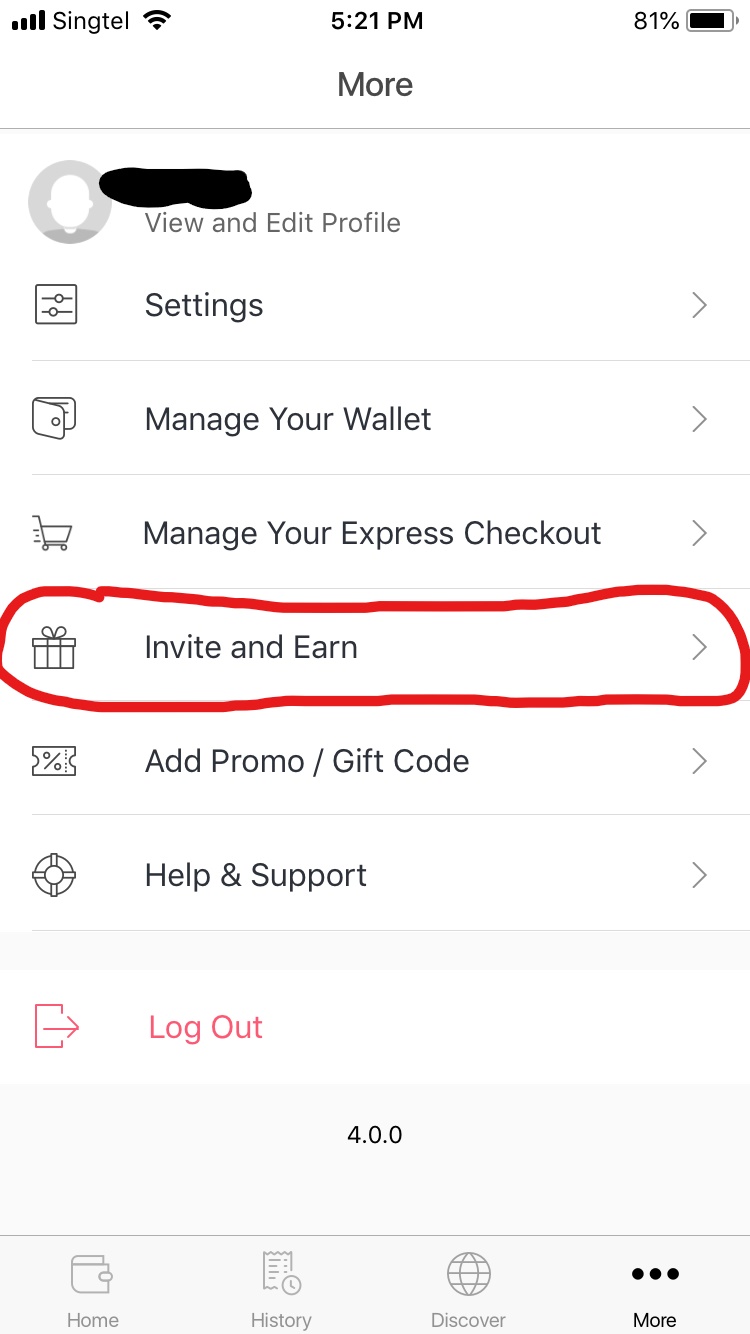

Recommended Post: Free $5 with DBS PayLah

Usually, it's better to start your research from the websites of the best property developers. Here is the list of the Top 10 property developers in Singapore, created by

https://www.asiapropertyhq.com/property-developers-singapore/ :

- Far East Organization

- El Development Pte Ltd

- City Development Ltd

- Frasers Centrepoint Ltd

- MCC Land

- Qingjian Realty

- GuocoLand

- Bukit Sembawang Estates Limited

- Hoi Hup Realty Pte Ltd

- CapitaLand

Take the

New Futura Condo for instance. If you were considering the condo, you would have to research to determine which size will fit you the best. You’ll also need to determine if you have the required budget for the beach facing view. Other things you’ll need to consider when choosing a condo is if its near to your place of work. Also, what type of maintenance costs you’ll incur.

Types of Properties You Can Buy – Freehold VS Leasehold

When buying property in Singapore, you’ll be faced with a choice between freehold and leasehold. The difference between the two is significant, and so that has influence over the price as well.

Freehold properties can be held by the owner forever or transferred to their kin.

On the other hand, leasehold properties will revert back to the state when the lease expires.

Lots of properties in Singapore are freehold. That means you can own the property for as long as you want and sell it when the time comes.

However, keep in mind that generally speaking freehold properties are 10% - 15% more expensive.

Price Valuation

Before you buy any property, you’ll want to get it valuated. Now even though property price has already been valuated, it is essential to make a comparison. When you compare the costs of this project with others, it becomes easier to estimate how big a loan you can or should get.

You should also consider the total duration of the loan and its subsequent monthly instalments.

Individual borrowers who don’t have an outstanding house loan, the LVL or Loan to Value Limit is 80%.

If the tenure exceeds 30 years or extends beyond the age of retirement of a borrower, then it's 60% of the property’s value.

Closing the Deal

Once the buyer and seller have agreed on a price, the sale can be completed. Completing the purchase will require paying the seller, and transferring the CT or ‘Certificate of Title’ to the purchaser.

The CT is only issued by the Singapore Land Authority (SLA). It is also proof that you own the property.

Your lawyer then inspects the CT. It is also at this point that the lawyer holds on to the CT.

The next couple of steps are handled by the lawyer. This usually requires that the solicitor holds the CT until legal formalities have been completed. After that, it is surrendered to the SLA, which then reissues a new CT in the name of the new owner.

It takes a total of around ten weeks for the process to complete. If a mortgage has been sought the solicitor lodges a caveat for the property and coordinates with the bank or any other financial institution.

Finally, the mortgage documents are prepared, and the property is officially yours.

Remember to offer your opinions.

If you don't put your two cents in, how can you expect to get change?

Have a feedback? Tell us now!

Subscribe to us or

Follow us:

InvestmentStab on Facebook

This article is brought to you by:

Author: Robert Lamp

Position: Ghostwriter in New Property Guide

Blogger Email: robertlamp10@gmail.com

.jpg)