If you got any questions/topics you would like us to talk about, let us know via the comments below or via this form.

You asked us what are some of the pros and cons of transferring money from your CPF Ordinary Account (OA) to your CPF Medisave Account (MA).

Here is the result of our research.

Background

If would like to know what is your Medisave Account for, click HERE.

But, long story short:

Can it be done?

Long story short: NO

You cannot transfer funds from your CPF OA to your CPF MA.

But, you can top up your CPF MA in 2 other ways.

- Voluntary contribution to all 3 CPF accounts (non-tax deductible)

- Medisave Account only (tax deductible)

Recommended Read: Why We Still Need Insurance Agent

The Pros of topping up CPF MA

Why would anyone want to top up to their CPF MA?

So why would anyone want to transfer money from your CPF OA to CPF MA, here are some of the reasons.

1. Extra interest

CPF OA pays 2.5%+ interest per year

If you are saving money for your medical bills, you are probably stashing it away in some low-risk portfolio that gives less than 1% interest per year.

If that's that case, why not allocate a portion of it into CPF MA, which pays 4%+ interest per year.

Of course, you would still need to keep a portion of it in cash because there's a portion of your medical bills that still requires cash payment.

Just moving money from your OA to your MA gives you an extra 1.5% interest per year.

2. Has a cap

Your MA savings is subjected to a cap, known as the Basic Healthcare Sum (BHS).

As of 2021, the BHS is set at $63,000 for those 65 years old and below.

Any amount that is in excess of your BHS will flow over to your

- CPF Special Account (SA) - if you are below 55 years old

- CPF Retirement Account (RA) - if you are 55 years old and above

So, technically, your CPF MA money is not a bottomless pit where money keeps going in without any way to take out unless you are hospitalised

Your CPF MA will reach a cap, after which money will flow into your CPF SA or CPF RA, where it can be withdrawn (if other conditions are met of course 😉)

For more information on the BHS, click HERE.

Recommended Read: Which Chinese Zodiac Has the Best Financial Outlook for 2021?

The Cons of topping up CPF MA

Here are the cons of topping up your CPF MA.

While you will get higher interest by making the transfer, there are also cons associated with it.

Here are the cons of transferring money from your CPF OA to CPF MA.

1. One-way street

You cannot un-do the top-up.

Once the money is in your CPF, it's going to be very hard for you to withdraw it out (except if you meet the various T&Cs).

Once you transfer from your CPF OA to your CPF MA, you cannot transfer it back from your CPF MA to your CPF OA.

2. Potentially no tax benefits

If you do a top-up via the Voluntary Contribution (VC), then there is no tax benefit.

However, if you do a voluntary CPF MA-only top-up using cash, the amount that you top up is tax-deductible. But, it will be subject to your maximum personal income tax relief cap.

However, if you transferred it from your CPF OA to CPF MA, there is no tax benefit.

3. Less cash

If you kept cash in your pocket, you can use it any way you like.

Pay for a mortgage, pay for a holiday trip, pay for medical bills, anything!

But once you put it into CPF, the things you can use it for will be subjected to limits and restrictions.

Topping up cash into your CPF MA, while will earn you higher interest, will restrict you to using it only for medical purposes and nothing else.

Some day down the road if you realised you need extra cash to pay for a home downpayment, you cannot withdraw it from your CPF MA to pay for the downpayment.

3. Less ways to use your funds in CPF

If you kept the money in your CPF OA, you can use it for housing, education, insurance premiums, and other purposes.

But if you transfer the money to your CPF MA, you can only use it for medical purposes or to pay for medical insurance premiums.

If you are currently paying your home loan using CPF, if you make a transfer to your CPF MA and cause your CPF OA to have insufficient funds to pay your monthly mortgage, then you might have to pay your mortgage in cash.

In which case, it might be better if you just top up cash into your CPF MA (since this is tax-deductible) while paying your mortgage is not.

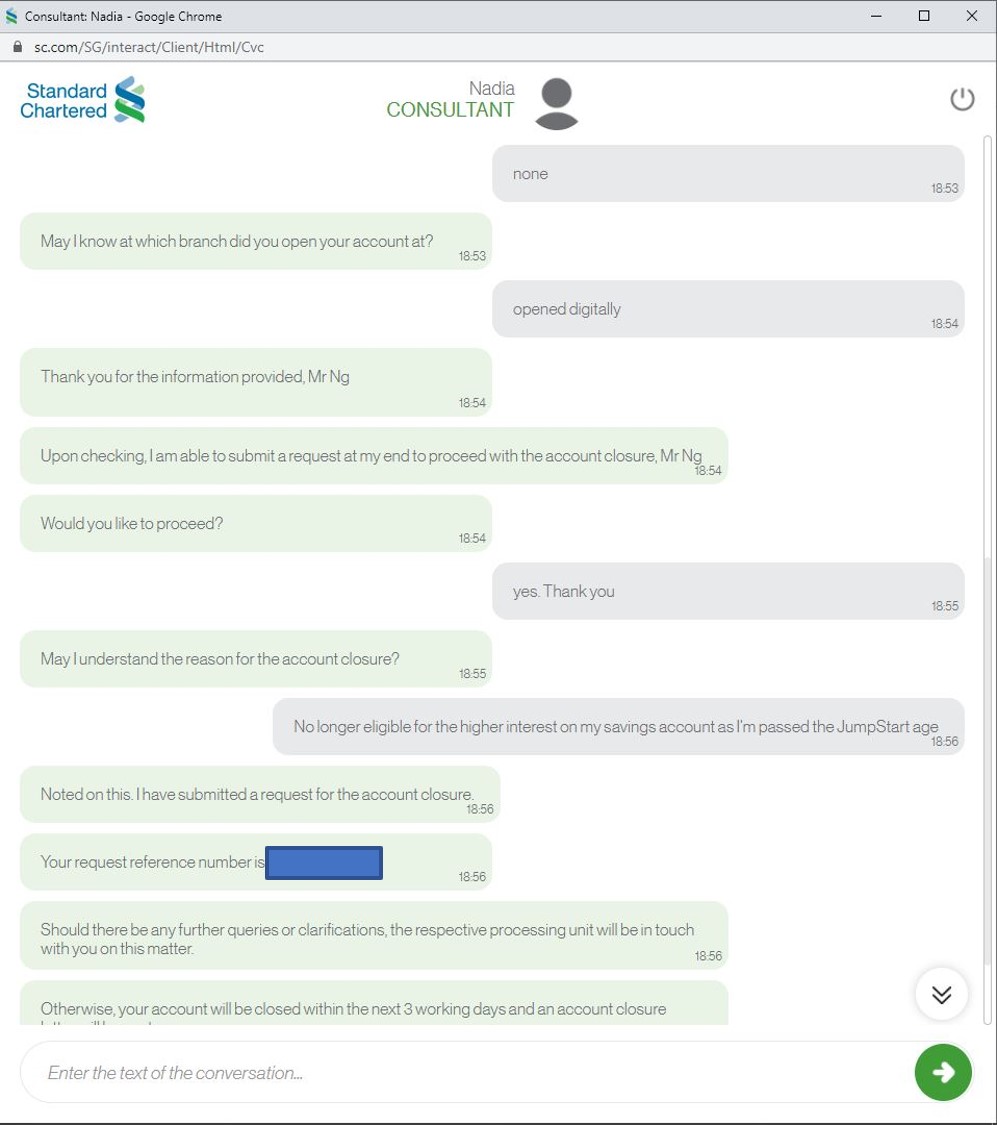

Recommended Read: Closing my Standard Chartered JumpStart Account

Conclusion

There is no one-size-fits-all solution.

For example, if you got sufficient funds in your CPF OA to pay your mortgage, and would like to grow your CPF MA faster and maximise the interest you are earning from CPF, then you can consider making the top-up.

But, there is no hard-and-fast rule.

Whether or not to top-up cash into your CPF MA depends heavily on your circumstances.

Whether or not to transfer the money from your CPF OA to your CPF MA, depends heavily on your circumstances.

Recommended Read: What I Learnt 6 Months into My SGUnited Traineeship

New Product Launch (Beta)

We are building a new platform to help you find people to share your family plan subscriptions with.

We help you find, match, subscribe and collect payment so that you don’t have to.

Convenience for you:

- You don't have to find people to share with you. We do it for you.

- You don't have to chase people to transfer you their share of the subscription fee. We do it for you.

- You don't have to remember to transfer your share of the subscription to that 1 person. We do it for you.

- You don't have to find it difficult to drop out of a family subscription plan because you shared it with your family/friends. We cover your share for you.

We like to know what you think about this service.

Let us know in the survey below what you think, and to be notified once we officially launch the product. 😉

Promos & Referrals

We are starting to build a list of Promos and Referrals for our readers.

Click here to view the full list of Promos and Referrals we have.

Hey You!

If you have a money related story about you or your relatives' that you want to share, let us know in the comments below or email us at investmentstab@gmail.com.

Alternative, you could fill in the form below for us to contact you.

Story Form

Dear Reader!

As we progress towards the next phase of our journey, we would like to find out what would make you like us even more.

We hope you could help us fill in a short survey of 8 questions (4 of them are MCQs) so that we can help tailor our content to you.

Survey

Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

Have feedback? Tell us now!

Follow us on Facebook and Instagram for more timely updates about finance-related articles and memes! 😁

Subscribe to our newsletter too in case social media platforms decide to stop showing you our content.