Source: CPF

In today's post, we will be discussing why is the Full Retirement Sum monthly payout not double the Basic Retirement Sum's payout.

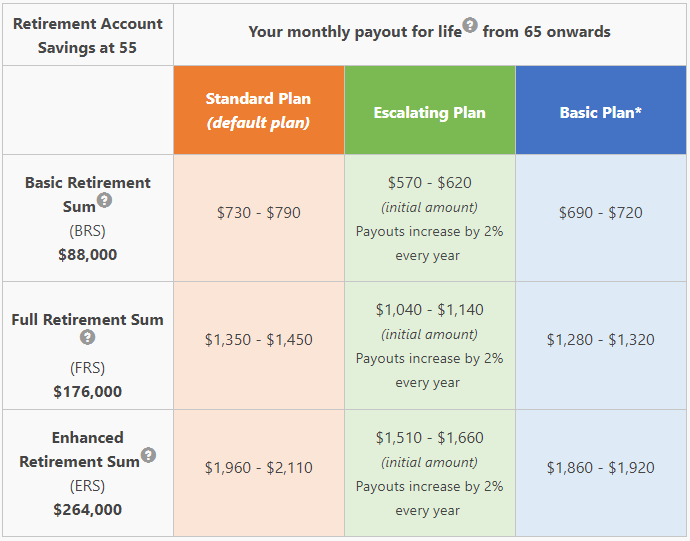

As you can see above, it is an image of the monthly payout you will get based on the different Retirement Sum savings you at have age 55.

Retirement Account Savings at 55:

The FRS is 2x of BRS.

However, the monthly payout from FRS is not 2x of BRS (2x of $730 = $1460).

The same is for ERS, where the payout is not 3x of BRS (3x of $730 = $2190)

This is because the Effective Interest Rates (EIR) on each Retirement Sum is different.

EIR is the real interest rate return you get from your money.

In 2019,

a) OA earns 2.5%

b) SA, MA & RA earns 4%

c) First $60,000 of your CPF balance gets extra +1%

d) First $30,000 of your CPF balance gets extra +1% if you are age 55 & above

FRS is 2x of BRS, however, the income derived from FRS is not 2x of BRS because the effective interest rate is not the same.

BRS enjoy a higher effective interest rate than FRS and ERS even though it will earn higher than the base 4%.

For a clearer picture on the EIR issue, please refer to our other post: EIR of CPF.

It will explain why is the effective interest on your CPF money decreasing as more and more money is accumulated in your CPF accounts

MORE LINKS

Accrued Interest More than Housing Profits?

CPF +1% Interest for those age 55 & Above

5 Financial Things to do in your 20s

Singapore Finance Minister on Personal Finance Part 2

Reducing CPF Housing Accrued Interest

CPF +1% Interest for those age Below 55

Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

Have feedback? Tell us now!

Subscribe to us or

Follow us: Investment Stab on Facebook

Unhappy with your job? There's something you can do about it.

A. Save up enough money from your job so that you can fire your boss - the problem is it might take some time and some effort

B: Find a new job, search for new opportunities. A career coach might be able to help you with that. And if you are looking for a free career coach, visit Workforce Singapore via the link below.

They can link you up with the career coach and you might be able to find new opportunities on their jobs portal.

http://ow.ly/GY8150wlfrF

Yup, you are correct.

ReplyDeleteThis is also why CPF is a good "socialised" long-term savings especially for Singaporeans who don't have high salary jobs.

More taxpayer monies "subsidise" smaller quantums of CPF balances.

This is also why for higher salary people, unless you are REALLY averse to taking market risk, it may not be a good idea to go for Enhanced RA.

But no, buying commercial endowments and/or annuities is not a better substitute than CPF LOL! Long-term returns for commercial endowments & annuities will likely be LOWER than even Enhanced RA ... while ironically taking on more risk, both systemic risk (recessions, financial crisis, trade wars, real wars) and unsystemic risk (solvency of insurance companies, investing capability of individual insurance companies, mgmt capability of insurance companies).

Hi,

DeleteMany private insurers have also said that it is hard for their own annuity plans to beat the returns given by CPF LIFE.

Nonetheless, people just aren't comfortable with their hard-earned money locked away in places they cannot touch.

I guess for commoners, withdraw-bility > good long-term returns

Not interested with ur mambo jambo..just return our full CPF when we reach 55..

ReplyDeleteAgree

DeleteHi,

DeleteGiving back a lump sum of money may sound like a good idea - but psychologically and research have shown that people who suddenly get a large sum of money (whether it's from their own pocket or from the lottery), the money tend to be all gone within the next 5 years.

If given back at 55, wouldn't that be a problem when our retirees reach age 60?

I Personally do not need to hear more craps from CPF. Every cents on there is my hard earned money. I want it all back when i am 55. Period!

ReplyDeleteFrom real life observations, those who keep demanding CPF at 55 are those without enough money, BOTH outside of CPF as well as inside their CPF.

ReplyDeleteGiving back all their CPF in a lumpsum is not a solution as they'll use up all the money within a few years or even just 1 year.

Then they'll be begging, harassing & badgering other people for money -- relatives, friends, strangers, moneylenders, loansharks, demanding at meet the people sessions for money from govt/taxpayers etc. Some will resort to more extreme actions.

I'm ok for returning of cpf at 55. Provided they will get the mandatory death penalty if they behave as above after that.

Ok.cpf payback by mthly instalment...to prevent those who receïved their fuľ retirement saving n squandered away n left begging on the street. Sound very caring frm a govt statboard.

DeleteWats happen for those wit little saving due to their low salary working wit low paying job...after few yearr receiving mthly instalment n probably dried up in their retirement saving.. Then how ??

Is the cpf gonna come up wit certain scheme where those who had dried up their retirement saving could stilĺ be taken care of..n not begging on the street. Ïf n after drvïng up their retirement saving n left these older folks in a lurch.. It makes no difference..begging on the street now n begging later..

There's a big difference --- in character & attitude.

DeleteMost of these KPKB people --- at most $50K or $100K total in CPF (including Medisave portion). $50K-$100K ... within 1 to 3 years all gone.

Getting only a few hundred dollars a month is TOUGH, I get it. You're forced to budget like hell & probably still have to work as toilet cleaner or dishwasher or security guard in your 60s & maybe 70s. BUT SO WHAT?!? Life is as it is.

The alternative is for the masses to feel that the system is unfair & resort to rebellion like current HK riots, French revolution, Russian revolution, 1911 overthrow of Qing, 1930s-40s China communist war, and the many countless rebellions in China's 6,000 year history of dynasties.

For those really penniless & cannot work can still get $600 per month social welfare. Of course tough luck if you're below 70 and still fit enough to work, even as cleaner. You may still qualify for a reduced amount of welfare though.

Is Okey to keep our CPF monies with CPF board but government should grant us loan up to certain amount (only once with interest)in case we need and charge us a percentage of interest to put back to our CPF monthly until we can fully paid up loan and this procedure is like what we are dealing with CPF monies to buy HDB flats..this way citizen will not be able to finish their monies after release at age 55.So no worries for government about old age insufficient fund for retirement..

ReplyDeleteHi,

DeleteThis actually sounds like a pretty good solution.

Except probably people will soon be complaining about the next item: why must I pay interest when I borrowing my own money :)

But it is does sounds pretty plausible

If given a choice most wud rather take a lump at 55 rather then wait till 67 some may not even reach there.. Ren chai tian tan 💰 chai cpf...

ReplyDeleteHi

DeleteI think everyone is always afraid of 2 things

1: Dead and money not spent finish

2: Alive but ran out of money

I think 2 is more scary

What about you? :)

just asked yourself if

ReplyDeletejust asked yourself if your cpf moneys are not force to save by the government, would you have so much moneys saved.Just hope that the withdrawal payout age and the monthly payout amount would not reduce much from when it's start to pay.

ReplyDeleteDon't be fooled. These are merely the ways to defer your payment. Policies always change from time to time. In the end your entire cpf cannot take out EVENTHOUGH you nominated beneficiaries. You can see that the govt is trying all sorts of ways to defer your cpf payment. It is our hard earn monies for our old age.

ReplyDeleteInvestment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto currency at some point not until I got a proficient trader Bernie Doran, he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony, I invested $2000.00 and got back $20,500.00 as my ROI within 7 business days of investment. His strategies and signals are prolific and accurate , I have also gained more knowledge on the trade market. If you are new to cryptocurrency I would recommend you contact him through Gmail : BERNIEDORANSIGNALS@GMAIL.COM or his WhatsApp : +1424(285)-0682 , tell him I referred you

ReplyDelete