Apps are no longer the next big thing. They take up space in our phones, requires us to download and continuously update them.

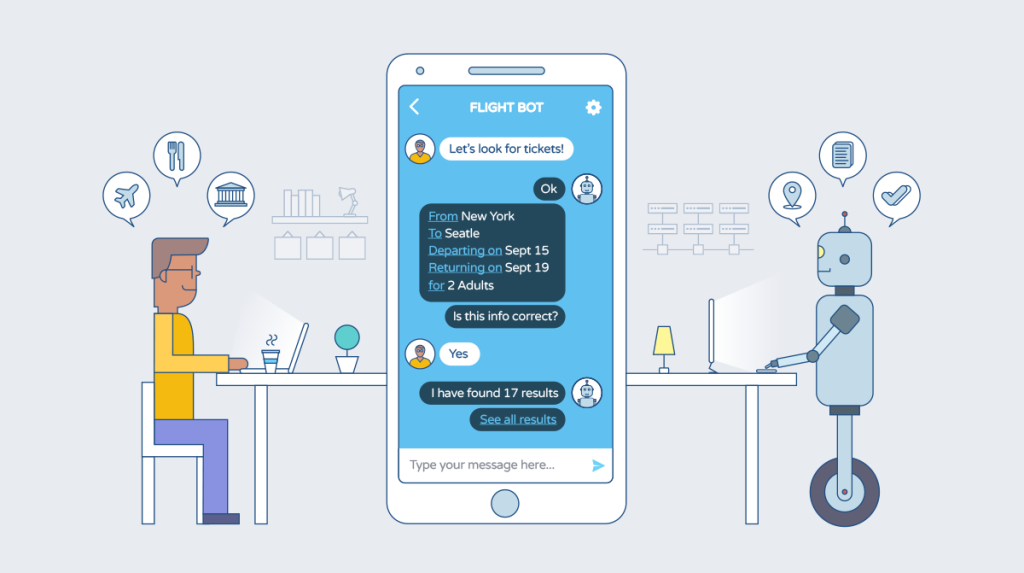

Instead, chatbots seem to be the next big thing.

Just a few years ago, the mantra was "there's an app for that".

Today, the mantra is "there's a chatbot for that".

Below, we share with you 4 chatbots on Telegram that can help you save and manage your money better.

The list is not comprehensive, with new chatbots being created every day!

As such, if you have any great chatbots that you use to manage your finances, feel free to comment and tell us about it!

We will add it to our list

1) Foodie Monkey Bot

This is the chatbot that sends you a list of food and drinks promo happening all around Singapore daily. Save on food and drinks sounds like a pretty good deal to me.

2) GetMedia Bot

This is the chatbot that lets you download songs and videos from youtube to your phone, saving you tons of data when you are commuting or at places without wifi - and hence saves you money.

Recommended Post: Free $5 with DBS PayLah

3) WhereIsMyMoneyBot

This is the chatbot that lets you track your expenses easily. Type the expenses you incurred and the amount and it will record. You also get a summary of your total expenses for the month and you can export the information in Excel out.

4) WhoPayBot

This chatbot helps you split your bill among your friends easier. Allows you to split the bill without complex mathematics and helps you track who has paid. No more having friends forget about transferring the meal money now that there is a reminder set for them.

Got any more chatbots that can help us manage our finances better?

Feel free to comment them to us and we will add them to the list

Recommended Post: 3 Reasons Stocks are Better than 99 Year HDBs

Remember to offer your opinions.

If you don't put your two cents in, how can you expect to get change?

Have a feedback? Tell us now!

Subscribe to us or

Follow us: InvestmentStab on Facebook

Instead, chatbots seem to be the next big thing.

Just a few years ago, the mantra was "there's an app for that".

Today, the mantra is "there's a chatbot for that".

Below, we share with you 4 chatbots on Telegram that can help you save and manage your money better.

The list is not comprehensive, with new chatbots being created every day!

As such, if you have any great chatbots that you use to manage your finances, feel free to comment and tell us about it!

We will add it to our list

1) Foodie Monkey Bot

This is the chatbot that sends you a list of food and drinks promo happening all around Singapore daily. Save on food and drinks sounds like a pretty good deal to me.

2) GetMedia Bot

This is the chatbot that lets you download songs and videos from youtube to your phone, saving you tons of data when you are commuting or at places without wifi - and hence saves you money.

Recommended Post: Free $5 with DBS PayLah

3) WhereIsMyMoneyBot

This is the chatbot that lets you track your expenses easily. Type the expenses you incurred and the amount and it will record. You also get a summary of your total expenses for the month and you can export the information in Excel out.

4) WhoPayBot

This chatbot helps you split your bill among your friends easier. Allows you to split the bill without complex mathematics and helps you track who has paid. No more having friends forget about transferring the meal money now that there is a reminder set for them.

Got any more chatbots that can help us manage our finances better?

Feel free to comment them to us and we will add them to the list

Recommended Post: 3 Reasons Stocks are Better than 99 Year HDBs

Remember to offer your opinions.

If you don't put your two cents in, how can you expect to get change?

Have a feedback? Tell us now!

Subscribe to us or

Follow us: InvestmentStab on Facebook