These are the list of books that I have read this year.

They span from economics & politics to business & investment.

This is probably not a lot to some people, but it's quite a number for me (particularly cause I'm a slow reader).

How did I find the time to read these books?

Well, between my full-time work and blogging, I sacrifice sleep.

Yup, there's no secret "time hack" or "productivity hack", I just sacrificed sleep and forced myself to read about 1 chapter a day, and more if I can on the weekends.

So, let's start looking at what I've read and my reviews.

Investment

1. The Deals of Warren Buffett

Type: Non-Fiction, Investing

I self-proclaim myself as a Buffettologist (a follower of Warren Buffett's investing style).

This book goes through the deals the Warren Buffett made in his early days and how he analysed the various businesses before he invests in them.

Definitely a good refresh for someone like me who had read a lot of books on Buffett, and definitely a good start for someone who wants to learn how to invest like Warren Buffett himself.

2. Value.able

Type: Non-Fiction, Investing

This book was written by an Australian fund manager who specialises in value investing.

If you frequently attend ShareInvestor's annual INVEST fair, you would probably have seen him around a couple of times.

It covers both the mathematical (how to calculate fair value, which uses a table that I've never seen before) and non-mathematical (what characteristics to look out for) parts of value investing.

If you want to add another methodology/calculation formula to your value investing arsenal, this is one book you can read.

3. Beat The Crowd

Type: Non-Fiction, Investing

I'm a huge fan of everything Ken Fisher writes.

What he writes is quite different from what is usually written in investment, economics, or finance books.

In this book, he focuses a lot less on the tactics (read his book 'Debunkery', which has a lot of great investment tips), and more on the mindset of how an investor should have and how to think.

I'll probably rate this in the top 3 among all the books he has written.

My personal favourite/top is still his 'Debunkery'.

4. Why Moats Matter

Type: Non-Fiction, Investing

A pretty good book, one that had me taking down a lot of notes because it was all about the tips and things to look out for when finding moats in businesses.

The first half of the book was spent explaining moats while the second half delved into the moat-characteristics to look out for in each specific industry.

Pretty useful if you are looking at certain companies to invest in and want to have a checklist to verify if it is a good company to invest in.

5. The Greatest Trades Of All Time

Type: Non-Fiction, Investing

A book that walks you through the history of the stock market, specifically on the top traders that made a lot of money in the financial markets.

The book introduces you to the top 10 famous traders who made a huge return in the financial markets, and how they did it.

Kind of like reading a summary of the various books that explained how each trader (people like George Soros) made their killing in the financial markets during the various different moments in time.

6. Charlie Munger The Complete Investor

Type: Non-Fiction, Investing

I have to admit, this book is quite dry, it became quite a struggle to finish it towards the middle of the book.

Basically, this is a no-math guide to value investing.

It talks about all the soft aspect of a good company and a lot about the mentality an investor should have.

Business

7. The Amazon Management System

Type: Non-Fiction, Business

This is one of the books that I'll probably re-read some time again in the future because everything inside is GOLD!

It's probably the best book I've read this year.

It talks a lot about what makes Amazon a successfully company, and how other companies can model themselves against one of the largest companies in the world.

Whether you're an employee, a small business owner, or a large company executive, this book is definitely a recommended read!

8. The Upstarts

Type: Non-Fiction, Entrepreneurship, Business

A book on Uber and Airbnb, how they got started, and how they became the giant they are today.

It's a really interesting read; it brings you into the companies and into the respective founders' heads.

It really explains the whole "do first, ask for forgiveness later" mentality, and maybe, just maybe, that should really be the way to go in the future?

9. Why I Left Goldman

Type: Non-Fiction, Banking, Business

Based on a true story (or at least that's what the author says), this book will show you the cultural change that took place in Goldman Sachs before the Great Recession of 2008.

Of course, this is based on 1 man's narrative of the whole situation, and culture is something that impacts everyone differently.

But it is still an interesting read nonetheless (I have a friend that read this several times already 🤷♂️).

10. Hit Makers

Type: Non-Fiction, Marketing, Business

This is probably a recommended-read for those in business and in marketing.

It explains a lot about how something can go viral, become iconic, or become a legend; while others languish, crash, or go unnoticed.

Master marketing and business will flourish, or at least that's what I got out of this book.

This is another book that successfully made it into my "will read again in the future" list 👍.

11. Hit Refresh

Type: Non-Fiction, Business

The book by Microsoft CEO, Satya Nadella, on how he took over the role of CEO and successfully changed the culture of Microsoft to become what it is today.

Inside, he wrote about his early years, his time at Microsoft, and what problems he faced when he took over as CEO.

It's quite a light read, nothing technical; mostly about the man's life and the road he sees ahead for the company and the tech industry.

12. Reed Hastings Building Netflix

Type: Non-Fiction, Business

The story of Netflix, how it started, who started it, how it grew, and where is it going.

All answered in this short ≤200 book.

A pretty nice read, kind of like a biography of both the founder and of the company.

Economics

13. Confession of an Economic Hitman

Type: Non-Fiction, Economics

This will probably be a pretty interesting read if I had not read Dan Brown's Origin before starting on this book.

After reading a fiction novel, it makes this book feels like a fiction novel too.

Not to mention it felt like a book that consists of many conspiracy theories all wrapped up into one.

Could be true, could be false, but you pretty much can't tell because it is almost like a one-man narrative of what's happening around the world.

If you want to read a non-fiction fiction story, I guess this is the book to go? 🤷♂️🤣

14. The Undercover Economist Strikes Back

Type: Non-Fiction, Economics

Do you believe that the free market is the best way to rescue an economy or believe that Government intervention is the best way to rescue an economy?

This book will tell you why both are a viable way of rescuing an economy, along with many other lessons about economics, like sticking prices etc.

And, I'm actually quite interested to read the previous book the author wrote before this book.

15. Big Debt Crises

Type: Non-Fiction, Economics

A book by Ray Dalio that can be finished in 1 afternoon.

Recommend that you read the appendix first before the book. The appendix is more useful than the bulk of the book.

The appendix explains the principles while the whole book is just examples of economic crises faced by countries over the years - it gets quite repetitive after a few examples actually.

16. Saving Capitalism

Type: Non-Fiction, Economics

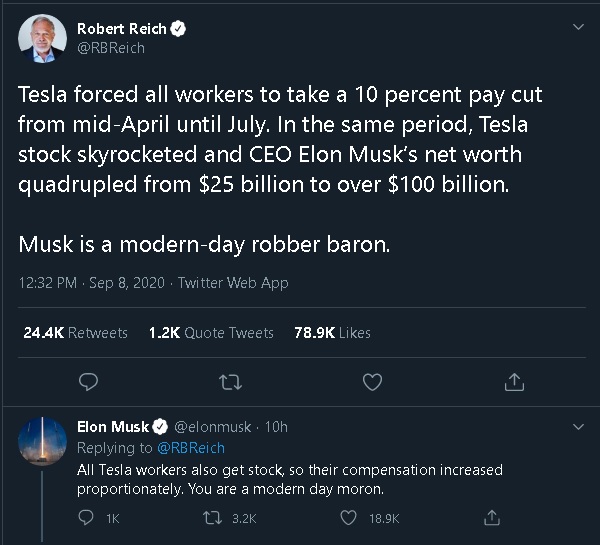

This is a book by Robert Reich, former Secretary of Labour under Ex-US President Bill Clinton.

If the above title doesn't ring a bell, maybe this might: he was recently called a "modern day moron" on Twitter by Tesla CEO, Elon Musk 😉.

I spent quite some time reading this book, and it's not because it's a tough read.

Rather, it is because I disagree with the book so much, I had to spend time making notes of what this book was trying to say, and time to joint down points I disagree with and why.

In fact, I might publish the list of points that I disagree with in this book, maybe in another post in the future.

This is probably one of the books that I had the most number of disagreement with 🤣.

Politics

17. Third World To First

Type: Non-Fiction, Politics

This is the X number of books I have read on or by The Man himself.

It is an interesting book on Lee Kuan Yew's view on Singapore and the world during the time 1965 to 2000.

A lot of him recounting the things that happened, how he assessed the situations and did what he did.

It's a man's view on history, and if you like history, then probably this book would interest you.

Fiction

18. Origin

Type: Fiction

The latest book by Dan Brown (although it is still several years old already).

Bookmarked for the longest time, so it was probably time to finish this up.

Doesn't disappoint!

Conclusion

As 2020 come to a close, did you learn or grow as a person?

Hey You!

Dear Reader!

Follow us on Facebook and Instagram for more timely updates about finance-related articles and memes! 😁