MORE LINKS

CPF Voluntary Contribution Rates

What to Own during Rate Hikes?

Fine Print of CPF Money Withdrawal

5 Financial Things to do in your 20s

Singapore Finance Minister on Personal Finance Part 2

Repaying CPF Accrued Interest - Why?

Reducing CPF Housing Accrued Interest

The book I am recommending today: The Most Important Thing: Uncommon Sense for the Thoughtful Investor by Howard Marks.

Honestly, from just skimming through the content page and back cover recommendations, this book looks like any other investment and finance book which "sells" you on conventional knowledge offered in many other books. However, what it presents is a wealth of knowledge that average investors do not note. An example of such is the following definition of risk, defined by the author himself, Howard Marks.

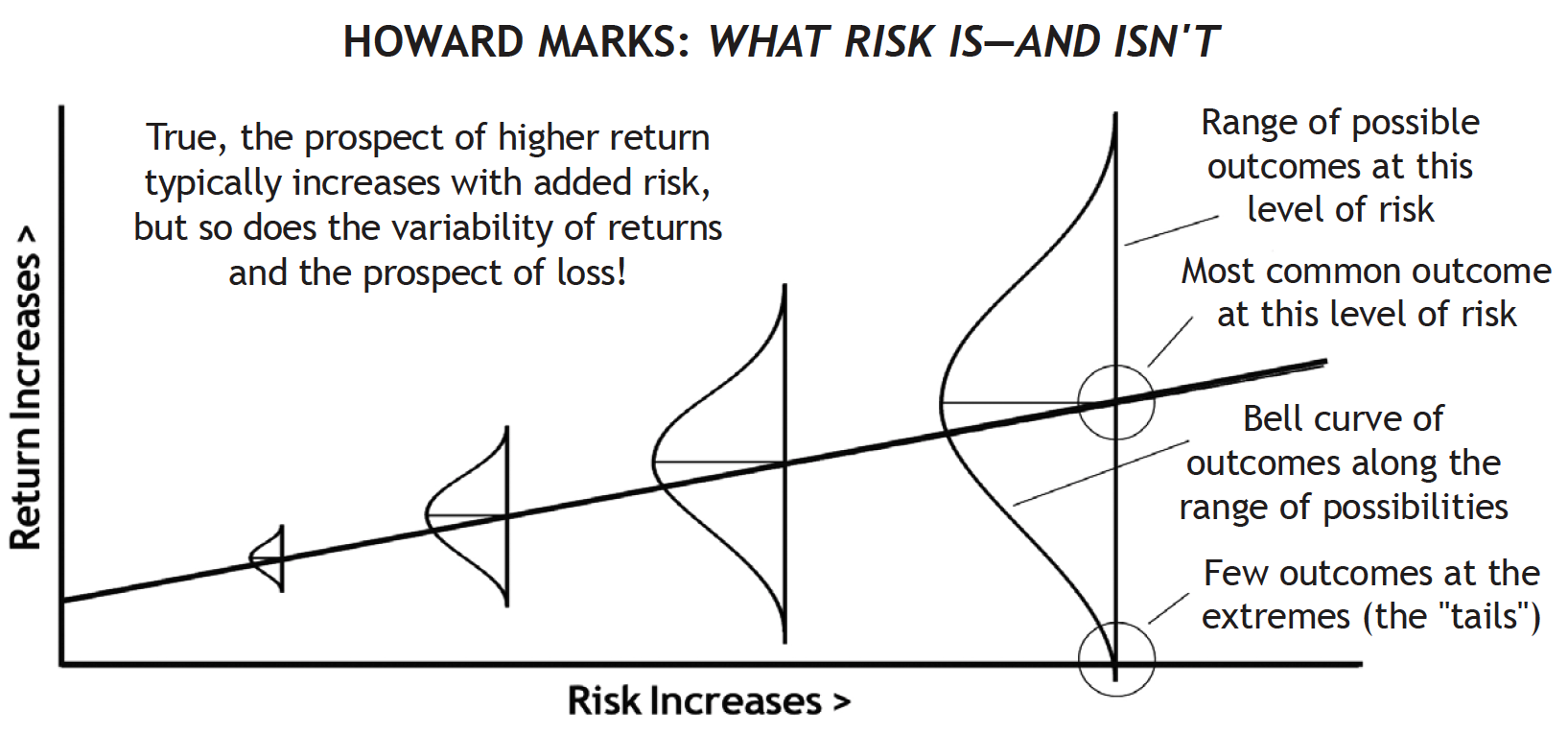

The diagram above shows the typical risk and return ratio that school generally preaches about, whereby higher risks should equate to higher returns and vice versa.

Source: bnpparibasmf

Source: Sound Mind Investing

However, what Howard Marks came out with, was this diagram above. While the general theory of higher risks equates to higher returns, he adds in 1 more variable into this consideration. The higher the risks, the higher the median of each rate of return and the greater deviation of the possible rate of return.

This basically means the higher your risks, the higher the chances of your expected rate of return fluctuates.

I came to realise the significance of this after taking a while to digest but I feel that it is something important to account for and not just taking unnecessary risks without accounting the consequences of it.

Share and tell us some of your opinions on the above. Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

Have feedback? Tell us now!

Subscribe to us or

Follow us: Investment Stab on Facebook

0 comments:

Post a Comment