Today we will be answering this question: How much is my Dependents' Protection Scheme (DPS) premiums?

DPS is a term-life insurance scheme that provides your family with a lump sum of $46,000 when you:

1) suffer from a terminal illness or total permanent disability

2) passed away

Its is term insurance and is meant to insure you until you reach the age of 60.

In simple words, it is a term life insurance that insures you up to $46,000 and is paid by your CPF money.

The insurance premiums are paid annually and the rates are as per below.

If you would like to know how to save on your monthly insurance cost, link HERE

| Age (as of last birthday) | Yearly Premiums |

|---|---|

| 34 years & below | $36 |

| 35 - 39 | $48 |

| 40 - 44 | $84 |

| 45 - 49 | $144 |

| 50 - 54 | $228 |

| 55 - 59 | $260 |

Assuming you started contributing to your CPF at the age of 16 (our first part-time job) and bought this insurance since then and continued it till you reach 60 years old, you would have paid out $4,504 in premiums for a $46,000 protection - sounds pretty worthwhile?

Source: ClearlySurely

So for 45 years of coverage, the CPF DPS worked out to about $100 per year in premium paid.

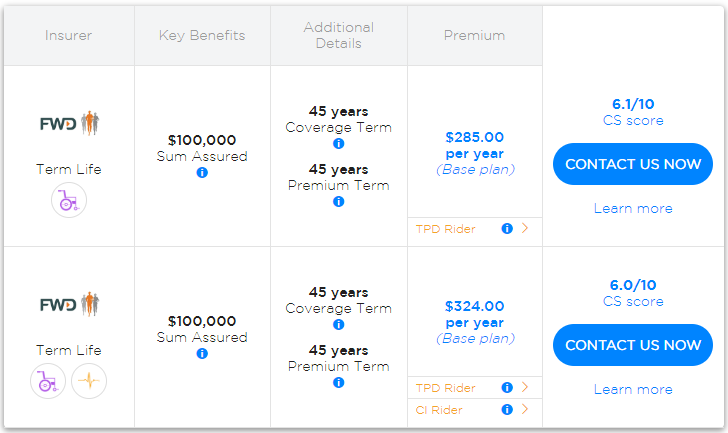

We did a search on ClearlySurely for the cheapest $100,000 term-life with 45 years of coverage, and it worked out to $285 per year in premiums (or $131 per year for $46,000 of coverage if we calculate it ourselves).

So private insurance is 30% more expensive than the CPF one.

Of course, just relying on the CPF one alone is not enough - you might need more protection for your family members and you probably need to supplement it with private insurance.

Recommended Read: How I Saved $1000 of my $2500 Salary

Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

Have feedback? Tell us now!

Subscribe to us or

Follow us: Investment Stab on Facebook

Unhappy with your job? There's something you can do about it.

A. Save up enough money from your job so that you can fire your boss - the problem is it might take some time and some effort

B: Find a new job, search for new opportunities. A career coach might be able to help you with that. And if you are looking for a free career coach, visit Workforce Singapore via the link below.

They can link you up with the career coach and you might be able to find new opportunities on their jobs portal.

http://ow.ly/GY8150wlfrF

0 comments:

Post a Comment