This is a follow-up article from our previous article on the Silver Housing Bonus (SHB): $20,000 Silver Housing Bonus: Should You Apply For It?.

Today's topic is on the 2 schemes that the Government has introduced to help elderly Singaporeans monetise their homes.

While it might not apply to you now, it might apply to your parents, grandparents, or older colleagues, in which case, you can share with them this article to let them know of these schemes.

Can I Join LBS after I got my SHB?

Source: Flickr

You are basically downsizing first, then selling the remaining lease of the downsized flat back to HDB.

You can apply for SHB after 55 years old and then apply for LBS after 65 years old.

But, you will only be eligible to apply for either the SHB bonus or the LBS bonus, and not both.

Meaning if you had gotten the SHB bonus, you will not be able to apply for the LBS bonus in the future.

Example:

Kumar is 60 years old, and he owns a fully paid 5-room HDB flat with his wife.

He wishes to downsize to a 2-room HDB flat since his kids are no longer staying with him and his wife.

He downsized to a 2-room HDB flat (resale) with 85 years of lease left and applied for the SHB (Yes, you have to apply for it!).

He expects his wife and him to stay in the flat for up to 45 years only.

So at age 65, after he has met the Minimum Occupancy Period (MOP) of his new 2-room flat, Kumar applied for LBS to sell back to HDB the 40 years of his 2-room flat's lease that he does not need.

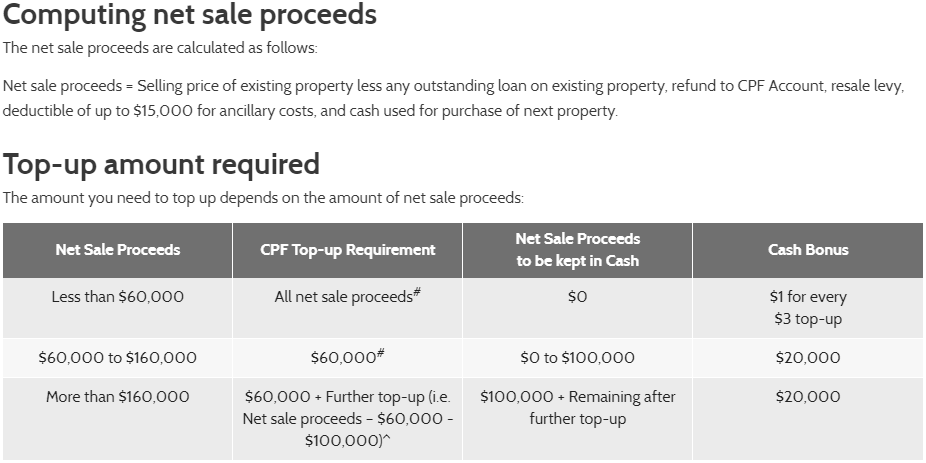

Kumar can get the following proceeds/bonus from SHB depending on how much net proceeds he earns from the selling and buying his flats.

Kumar can get the following proceeds from LBS, with funds used to top up his and his wife Retirement Account (RA) to their respective Retirement Sum (RS) requirement.

Kumar can then withdraw in cash the amount in excess of the RS requirement.

Recommended Read: Why are there 2 Schemes to Top Up CPF?

Can I get SHB after I joined the LBS?

From what we read on their FAQ site, it is 'NO'.

But, there is some ambiguity in how they phrased the answer in the FAQ.

So to save you the trouble, we have asked HDB on your behalf and we will post the answer here once they replied us 😉

Conclusion

Plan your moves wisely!

Since you can only get either an SHB bonus or an LBS bonus, make sure you think carefully which one gives you the most amount of bonus dollars!

Next, since you can start with SHB then LBS, but not LBS then SHB, be careful and don't rush into LBS!

WSG can provide you with a career coach that is able to help you with that.

And if you are looking for a free career coach, visit Workforce Singapore via the link below.

They can link you up with the career coach and you

might be able to find new opportunities on their jobs portal.

Recommended Read: Can I Use CPF to Buy a House After 55 Years Old?

Happy Lunar New Year!

As we progress towards the next phase of our journey, we would like to find out what would make you like us even more.

So we hope you could help us fill in a short survey of 8 questions (4 of them are MCQs) so that we can help better tailor our content to you.

Survey

Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

0 comments:

Post a Comment