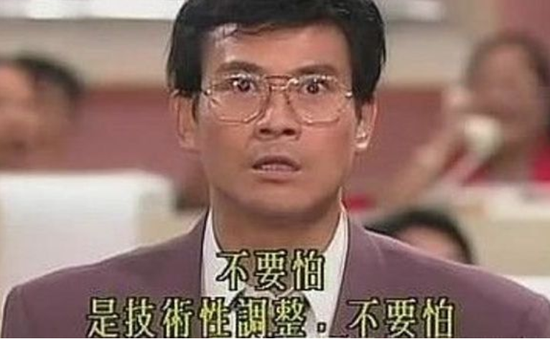

Caption: Don't fear. It's just a technical recession. Don't fear.

Last week we wrote a story on whether or not you should invest in the stock market now since we have entered a bear market.

Short answer: YES!

Full article here: Should I Invest now that We are in a Bear Market?

There is a lot of panic and fear in the stock market and in communities now.

Malaysia declared a lockdown and suddenly Singapore experienced another wave of panic-buying in supermarkets, although it was less severe than the first panic-buying wave in February.

Stock markets around the world entered bear market territory (dropped more than 20% from their peak).

I heard many people commenting that they expect the stock market to fall even more or that it will be a long time before stocks can recover from this shock.

These are not amateur investors, these are fairly good and experienced investors, many of whom often preach the mantra "don't time the market", but suddenly they all become market-timers and predictors of the stock markets.

Can you sense some irony here?

Now, we don't know when the stock market will bottom out and when the stock market recovery will start.

It is at this moment that I usually refer to Warren Buffett's famous quote.

He doesn't look at economic conditions, stock market conditions, or any other conditions.

He only focuses on 1 thing: Buying wonderful companies cheaply.

And crises are situations that allow stock prices to drop drastically such that he can buy these wonderful companies cheap.

What Businesses Are Wonderful?

Warren Buffett defines wonderful businesses as

1. Has a moat (strong competitive advantage)

2. Consistent earning power (growing revenues and profits)

3. Low/no debt (as little as possible)

4. Honest and competent managers (ran the operations smoothly over the years)

Our Thoughts

At the current stage, it might seem like no businesses are spared from the COVID-19 onslaught.

But remember, we are not looking at what happens during this crisis, but what will happen after this crisis, when everything goes back to normal.

Now is the time to invest in companies that you believe will outlive this crisis and resume their path to growth afterwards.

Don't think COVID-19 is going to make us stop buying things from Amazon, not use Microsoft Office, not use Apple services, or stop scrolling Facebook.

Now that most of us are stuck at home, we are probably going to be watching more Netflix, not less.

We are still going to watch Cable TV (if people still do such a thing) and use WiFi.

Industries that aren't directly affected by the COVID-19 situation but nonetheless got their stock prices falling, like technology, banking, telecom, or utilities, might provide good investing opportunities if you try to find those that are really well managed and funded.

Conclusion

I watched an interview recently made by the founder of Oaktree Capital Management, Howard Marks.

He was commenting on his fund's investment during the 2008 Global Financial Crisis.

He said, "You don’t need conservatism, caution, risk control, discipline, patience, or selectivity. You need (to have) money and the nerve to spend it."

I thought this was a pretty appropriate quote to be used in the current COVID-19 situation as well.

Are you daring enough to make the move, and wait patiently for the recovery to come?

Disclaimer:

Do not make any investment decisions based upon materials found on this website.

Investment Stab is not a registered investment advisor, broker-dealer, and am not qualified to give financial advice.

Investors are reminded to do their own due diligence and invest according to their risk appetite.

WSG can provide you with a career coach that can help you with that.

And if you are looking for a free career coach, visit Workforce Singapore via the link below.

They can link you up with the career coach and you

might be able to find new opportunities on their jobs portal.

might be able to find new opportunities on their jobs portal.

Recommended Read: Why are there 2 Schemes to Top Up CPF

Dear Reader!

As we progress towards the next phase of our journey, we would like to find out what would make you like us even more.

So we hope you could help us fill in a short survey of 8 questions (4 of them are MCQs) so that we can help better tailor our content to you.

Survey

Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

Good post. Thanks for the reminder.

ReplyDelete