We are going to break down the whole survey released by OCBC recently that caused quite a hoo-ha in Singapore.

Instead of looking at the Straits Times article, we will be looking straight at the source: the OCBC Survey.

Survey Demographics

The survey was conducted mid-May, 1.5 months into the Circuit Breaker period.

Reducing Investments

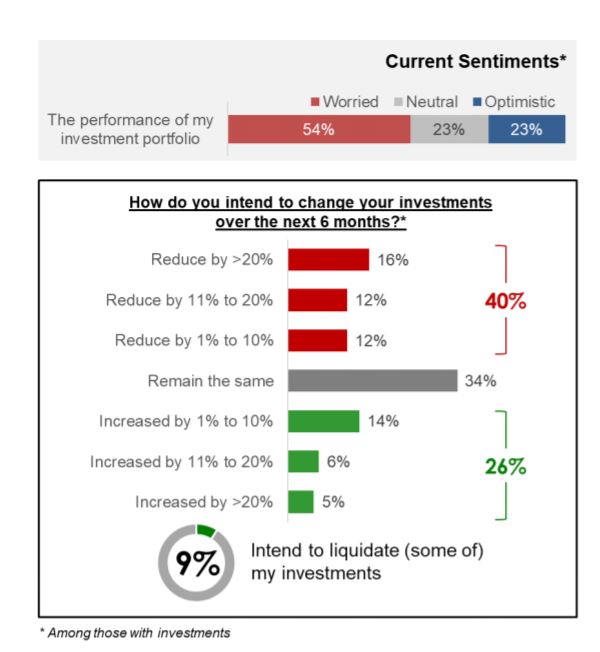

"40% saying they (the respondents) intend to reduce their investments."

The survey didn't go into detail why the respondents were reducing their investments (could be to buy a new car, pay for child's education, etc.).

But, 54% of the respondents did say they were worried about their portfolio, so it is safe to assume they probably are reducing their investments because they are worried their portfolio value might drop.

Everyone has different cashflow and financial needs to meet, hence it is normal to reduce their portfolio.

However, if one is reducing their portfolio to get cash to pay for their daily expenses during crises (like now), then maybe it is not such a great idea yet for that person to be investing.

Before investing, one would want to have at least 6 months of salary tuck aside as emergency savings.

If you don't have that, don't even start investing.

The purpose of that emergency savings is so that one can have at least 6 months of leeway to figure out what's the next step without selling their portfolio at low prices.

If one sells during crises, the probability of suffering a loss is really high.

Stopping/Reducing Funds for Retirement

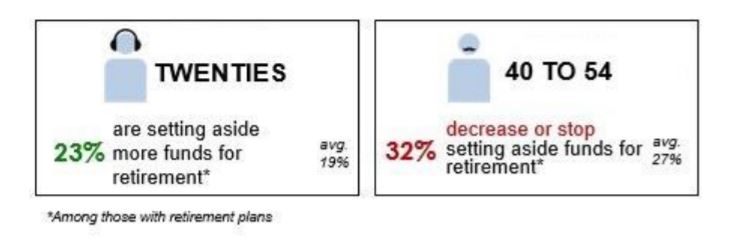

"27% of those with financial plans said they have stopped setting aside or even reduced their funds for retirement.

A third (32%) of the sandwiched generation - those between the ages of 40 and 54 and many of whom must take care of both young children and ageing parents – said they have cut down on such funds.

In stark contrast, 23% of those in their 20s with a retirement plan have put aside more money for this goal during this time of uncertainty."

I can vaguely hear online commenters shouting:

"If I can't even survive today, what for save for the future!"

Actually, if you can, now might be one of the best time to plan for your retirement.

Assets like stocks are selling cheap (low).

Stock market mantra: buy low, sell high.

If you don't invest now, then when are you going to invest?

Reducing Their Savings

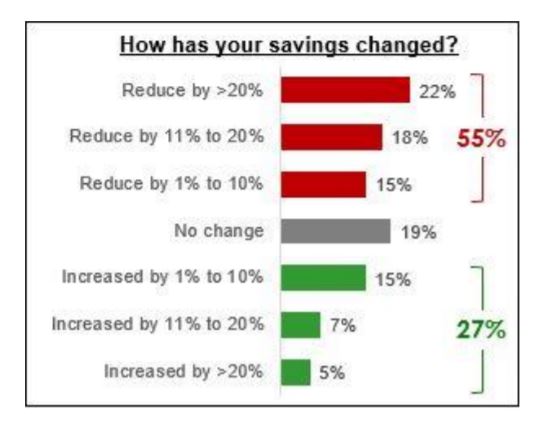

"55% of those surveyed said they have reduced their savings with 22% saying the reduction is more than 20%."

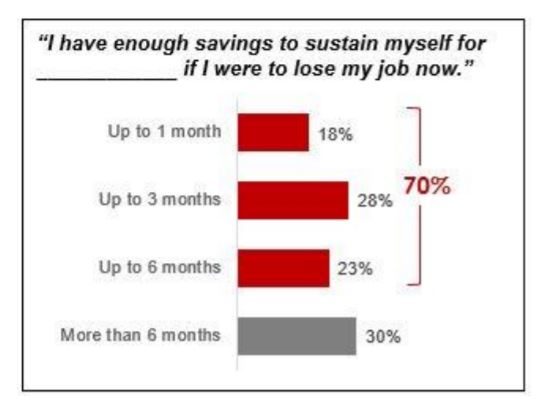

"Only 30% can sustain themselves for more than 6 months if they were to lose their job now. 18% of them have enough savings to cover only up to one month of expenses."

If we take a worst-case scenario, Circuit breaker took into effect on April.

From April to mid-May (the survey period) is 1.5 months.

We assume that everyone lost their job and are relying on their income to sustain themselves.

1.5 months of savings used to survive April to mid-May + 1 month of savings left = 2.5 months of savings at the beginning of April.

Basically, about 18% of the respondents had set aside less than 2.5 months of their monthly salary as emergency savings.

Just saying, the usual recommended emergency savings amount is at least 6 months of salary.

The good news is, the majority (between 53% to 88%) of the respondents seems to adhere to the 6 months guideline.

Moral of the story: save at least 6 months of your salary as emergency savings next time!

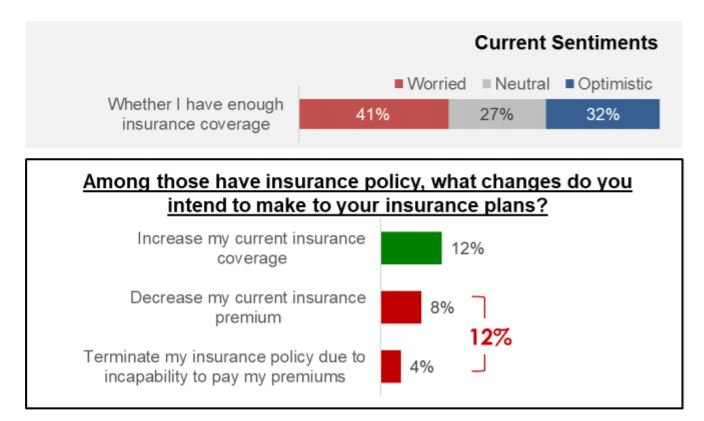

Not Having Enough Insurance

"41% are worried if they have enough insurance coverage with 47% of Singaporeans aged between 40 and 54 the most concerned."

The worse scenario is terminating your insurance because you cannot afford the premiums.

Because it will be more expensive/harder for you to buy the same amount of coverage in the future when you can afford it.

If you bought life insurance when you are young and terminate now.

The next time you want to buy life insurance again, you would have aged and your health would not be as great as when you were younger.

The premiums are probably going to be much more expensive.

If possible, keep paying your premiums or simply defer the premiums until a later date.

In case you do not know, you can actually defer your premium payments (Yes, Gahmen approve liao).

Talk to your insurance agent about it, defer instead of terminate.

Conclusion

Lesson 1:

Save at least 6 months of your salary as emergency savings.

Lesson 2:

Defer your insurance premium payments instead of terminating.

Lesson 3:

Invest for the long-term and for retirement.

Especially if you can afford to and when stocks are relatively cheap.

Recommended Read: Must I Top-Up Cash To Pay Back My CPF Accrued Interest If I Sell My House?

Hey You!

If you have a money related story about you or your relatives' that you want to share, let us know in the comments below or email us at investmentstab@gmail.com.

Alternative, you could fill in the form below for us to contact you.

Story Form

Dear Reader!

As we progress towards the next phase of our journey, we would like to find out what would make you like us even more.

We hope you could help us fill in a short survey of 8 questions (4 of them are MCQs) so that we can help tailor our content to you.

Survey

Have feedback? Tell us now!

Follow us on Facebook and Instagram for more timely updates about finance-related articles and memes! 😁

Subscribe to our newsletter too in case social media platforms decide to stop showing you our content.

0 comments:

Post a Comment