If you are 18 to 26, this StanChart JumpStart savings account should be the savings account of your choice.

Account Benefits:

- 2% p.a. interest on deposits up to $20,000. 0.1% (the prevailing interest rate) for balances above $20,000.

- No fees and minimum deposit balance required

- 1% p.a. cashback on eligible debit card spendings

Compared Against Other Savings Accounts

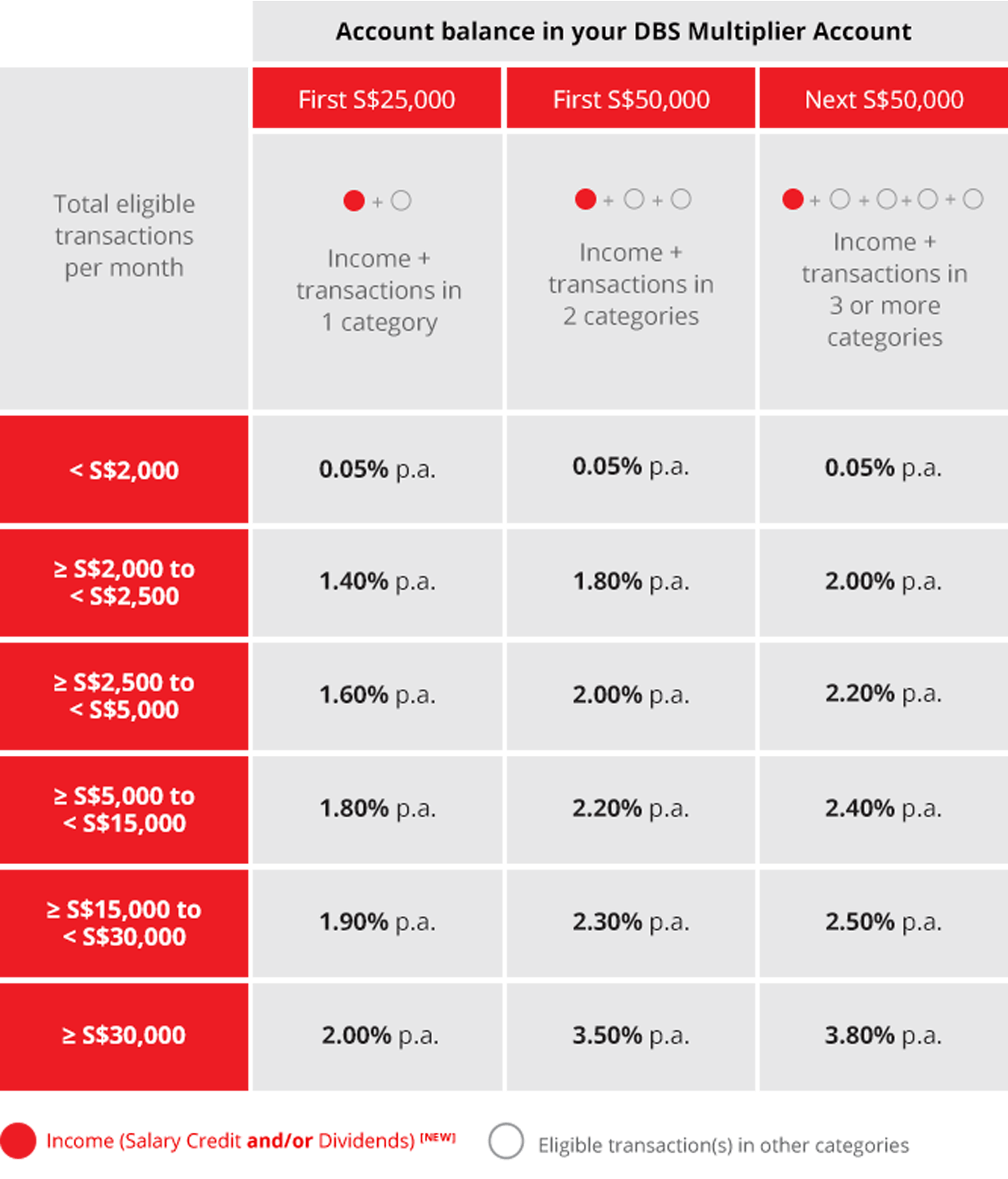

The 2 other more popular high-interest savings plans are the OCBC360 (effective interest of 3.45% p.a.) and the DBS Multiplier (up to 3.8% p.a.).

However, for DBS and OCBC, to get higher interest rates from these banks, you need to have performed several eligible transactions.

For example, to earn 2% interest for your first $25,000 from the DBS Multiplier account, you need to credit your salary and transact in at least 1 category (credit card spending, mortgage repayment, insurance, or investment).

However, for the Standard Chartered JumpStart account, there are no transactions required to fulfil to earn the 2% interest.

DBS Multiplier account requirements to earn higher interest.

Source: DBS

OCBC360 account requirements to earn higher interest.

Source: OCBC

Recommended Read: What Should I Invest In This Bear Market?

Why This Is For You?

If you are someone with huge savings (>$50,000), or has a mortgage, or is investing, or has bought insurance from DBS or OCBC, then the OCBC360 and DBS Multiplier account might be more suitable for you than the StanChart JumpStart.

For young adults age 18 to 26, some are in NS, some are studying, and some are already working.

At these stages of our lives, we don't have a lot of financial activities to qualify for the high interest given by the other banks like DBS and OCBC.

In that case, maybe the JumpStart account is a better choice for you.

Our Take:

If you are 18 to 26 years old:

Unless you are getting 2% interest on your $20,000 savings via other savings account, it might be better for you to save your money in this StanChart JumpStart account.

If you are a parent with a kid(s) that are 18 to 26 years old.

- Tell them to create this account and save money inside to earn higher interest.

- If they don't want to switch bank account, then use their name to open the account. But instead of depositing their money, you deposit your own savings and earn the 2% interest for yourself.

You will no longer get the 2% p.a. interest, but instead will start getting the prevailing interest rates of 0.1%

How Do I Sign Up For the StanChart JumpStart Savings Account?

You can use your SingPass MyInfo to sign up for the JumpStart account.

You can click this LINK to submit your application.

You can find out more information about the JumpStart account HERE.

BONUS

We created a referral page on our site that lists a bunch of referral codes you can use to get great deals.

One of them includes a $128 cashback if you sign up for a Standard Chartered credit card.

You can click HERE to view our list of referrals.

Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

0 comments:

Post a Comment